What Is the Formula for a Monthly Loan Payment?

Figuring out how much you owe on your loan can be intimidating and confusing. But it doesn’t have to be! Knowing the formula for a monthly loan payment can help you take control of your debt and give you peace of mind.

In this blog post, we will break down what goes into calculating each month's payment so that you can understand – and plan for – precisely how much is due anytime your next bill arrives.

Read on to learn more about the formula used to determine a monthly loan payment and why this calculation matters!

Definition and Examples of Monthly Loan Payments

A monthly loan payment is an amount due each month by a borrower to repay a loan.

For example, if you have taken out an auto loan with a principal of $20,000 and an interest rate of 5%, your monthly payments will be based on the formula for calculating a monthly loan payment.

This same formula can determine the monthly payments for any type of loan, such as a mortgage, student loan, and personal loan.

What Is the Formula for a Monthly Loan Payment?

The formula to calculate a monthly loan payment is based on three variables:

- The principal borrowed

- The interest rate

- The length of the loan.

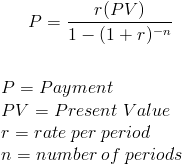

The formula is as follows:

Monthly Payment = Principal * (Interest Rate / 12) / (1 - (1 + Interest Rate/12) ^ (-Number of Payments))

Let's break down each part of the formula and explain what it means:

Principal - This is the amount you borrowed.

Interest Rate - This is the annual interest rate from your loan agreement. It should be divided by 12 to get the monthly interest rate.

Number of Payments - This is the number of payments you must make over your loan.

Using this formula, you can calculate a monthly payment for any loan regardless of its terms or amount borrowed. By understanding how the monthly loan payment is calculated, you can better prepare for your financial future and stay on top of payments.

How Do You Calculate Monthly Loan Payments?

Calculating your monthly loan payments is easy by using the formula above.

First, take the principal amount borrowed times the monthly interest rate.

Then, subtract one from the result of 1 plus the monthly interest rate raised to the negative power of the number of payments.

Finally, divide that answer by the previously calculated amount, and you have your monthly payment!

For example:

- Let’s say you took out a loan for $20,000 with a 5% interest rate and a term length of 5 years.

- First, calculate the monthly interest rate: 5%/12 = .004167

- Next, calculate your monthly payment: 20,000 x .004167 / (1 - (1 + .004167) ^ (-60))

- Your monthly payment would be $377.42

By understanding the formula for calculating monthly loan payments, you can more accurately budget and plan your financial future. It’s also important to remember that there may be other costs associated with your loan, including loan origination fees and closing costs, so make sure to factor those in.

How Do the Loan Payment Calculations Work?

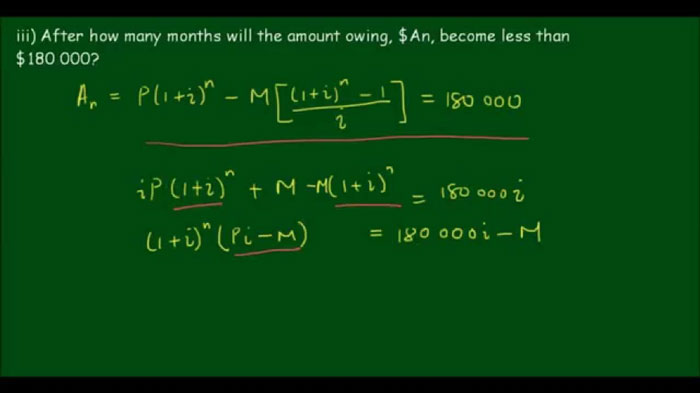

The monthly payment calculation is based on the equation for a loan amortization schedule. This equation considers the interest rate, term length, and principal borrowed to calculate how much you will pay each month.

When you make a payment on your loan, some of that amount goes to cover the interest, and the rest goes toward the principal. Each month, the interest you owe decreases as a portion of your payment is applied to the principal balance.

By understanding how this calculation works, you can better prepare for loan payments and budget each month accordingly. This can also help you identify potential problems with loan payments, such as if you are paying more in interest than the principal balance. Knowing how monthly payments are calculated can help you to make better financial decisions and improve your overall financial health.

What It Means for Consumers

The formula for calculating a monthly loan payment is an important tool for understanding the financial impact of taking out any loan. Knowing how much you will be paying each month can help you budget accordingly and make sure your payments are manageable.

It’s also important to understand the other costs associated with taking out a loan, such as a loan origination fees and closing costs. Be sure to factor these in when calculating your monthly payment so that you aren’t caught off-guard when it comes time to make the payment.

By understanding the formula for monthly loan payments and other associated costs, you can be better informed about loan payments and how they can impact your financial health. This knowledge can help you better budget, plan for the future, and stay on top of payments.

FAQs

What is the formula for calculating a monthly loan payment?

The formula for calculating a monthly loan payment is: Principal amount borrowed x Monthly interest rate / (1 – ( 1 + Monthly interest rate )^-Number of payments)

How do you calculate the monthly interest rate from an annual percentage rate (APR)?

To calculate the monthly interest rate, divide the APR by 12 months. For example, if your loan has an APR of 5%, your monthly interest rate would be 0.004167 (5%/12).

Can I use this formula to calculate payments on any loan?

Yes, this formula can calculate payments on any type of loan, including car, personal, home, and business loans.

How does this formula consider the term length of my loan?

The loan length determines the number of payments in months. So if you have a 5-year loan, the number of payments would be 60 (5 years x 12 months).

What other costs are associated with taking out a loan?

In addition to the monthly payment you calculate using this formula, other costs may be associated with taking out a loan. These could include loan origination fees and closing costs. Be sure to factor these in when calculating your monthly payment, so you aren’t caught off-guard.

How does the loan amortization equation work?

The loan amortization equation considers the interest rate, term length, and principal borrowed to calculate how much you will pay each month. When you make a payment on your loan, some of that amount goes toward the interest and the rest toward the principal balance. As payments are applied each month, the interest you owe decreases as a portion of your payment is applied to the principal balance.

What do I need to know about making loan payments?

It’s important to understand how monthly payments are calculated and other costs associated with taking out a loan. Also, budget accordingly and determine if your payments are manageable.

How can understanding the formula for monthly loan payments help me?

Understanding the formula for monthly loan payments can help you better plan for the future and remain on top of your payments. It can also help you identify potential problems with loan payments, such as if you are paying more in interest than the principal balance.

What other financial decisions should I make when taking out a loan?

In addition to understanding how monthly payments will be calculated, it’s important to consider your overall financial health before taking out a loan. Consider factors like your credit score and debt-to-income ratio to ensure you can comfortably handle the loan payments.

Is there anything else I should know about the formula for monthly loan payments?

It’s important to remember that this formula only provides an estimate of what your payment will be. Confirm with your lender the exact amounts associated with taking out the loan, such as closing costs and origination fees. This will help ensure that you are prepared when it comes time to make a payment.

Conclusion

This article has provided an overview of the formula for calculating a monthly loan payment and how it can help you better plan for the future.

Understanding other costs associated with taking out a loan is important; budget accordingly and consider your overall financial health before committing to a loan. Knowing these things can save you from potential financial stress in the future.