What Is the FICO Score 8? | Amazon

Money and credit can be tricky thing to manage - it has the potential to make or break you. Knowing all about this makes understanding your FICO Score 8 essential. You might have heard of it, but do you know what having a good FICO score means for your financial future? At its core, the FICO Score 8 is an indicator that lenders use to give them vital insight into how trustworthy and reliable you are with money management over time. To get a more in-depth overview of why the FICO Score 8 is so important, keep reading!

What is the FICO Score 8, and what does it measure?

The FICO Score 8 is between 300 and 850, indicating your creditworthiness. It considers five key factors - payment history, amounts owed, length of credit history, credit mix, and new credit - to create an overall picture of how you manage your finances. It’s important to note that the FICO Score 8 model has been the standard for credit scoring since 2009.

It’s important to understand where your FICO Score of 8 stands because it can make all the difference in whether you’re approved or denied loans and credit cards. Moreover, a higher score may result in better loan terms, from lower interest rates to higher approval amounts.

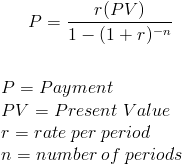

How is the FICO Score 8 calculated, and what factors are considered?

As mentioned above, the FICO Score 8 considers the following five factors:

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- Credit mix (10%)

- New credit (10%).

It also considers more than a dozen other variables, such as late payments, bankruptcies, and income.

The payment history accounts for 35% of the FICO Score 8 calculation - meaning that any missed or late payments will hurt your score. Similarly, amounts owed take up 30%, so it’s important to keep your balances low and avoid maxing out your cards. The length of credit history takes 15% into account, so it’s important to maintain older accounts and keep them active. The credit mix is based on 10%, which means having multiple types of debt (such as a mortgage or a car loan) can help boost your score.

Why is the FICO Score 8 important, and how can it be used to improve your credit score rating?

Your FICO Score of 8 is one of the most important factors in determining your creditworthiness. A higher score can help you open loans or credit cards with lower interest rates and may even increase your chances of getting approved for a loan.

You can improve your FICO Score of 8 by paying all bills on time, avoiding maxing out cards, and maintaining a good credit utilization ratio. You can also take out small loans or open secured credit cards to help build your score. Finally, be sure to create an emergency fund to protect yourself from any unforeseen financial difficulties that may arise - this will not only improve your overall financial health, but it will also boost your FICO Score of 8.

A good FICO Score of 8 is essential for your financial health - it can open up access to low-interest loans and credit cards, improving your overall money management over time. Keep the five key factors that make up the FICO Score 8 in mind: payment history amounts owed, length of credit history, credit mix, and new credit. With informed financial decisions, you can work towards increasing your FICO Score 8 rating!

What steps can you take to improve your FICO score rating?

You can take several steps to improve your FICO Score 8 rating. First, ensure all bills are paid on time and in full. Being late with a payment could significantly hurt your score, as it is one of the most important factors considered by the model. Additionally, strive to keep credit utilization down if possible – using credit wisely and keeping balances low.

Second, maintain a good mix of revolving and installment accounts. This helps demonstrate that you can responsibly manage different types of debt and will likely positively impact your score.

Finally, create an emergency fund so that you won’t have to rely on credit if unexpected expenses arise. These steps can help you improve your FICO Score rating and put you in a better position to get the best loan terms or credit card offers.

Overall, the FICO Score of 8 is an important factor for financial health and should not be taken lightly. Knowing what factors affect your score and how to focus on improving it can help you get access to better loan terms and credit opportunities. Taking proactive steps such as maintaining a good payment history, keeping credit utilization low, and building an emergency fund can all lead to a higher FICO Score 8 rating over time.

How often should you check your credit score rating, and how can you get a copy of your credit report?

It is a good practice to check your credit score rating at least once per year. This can help you identify any errors or changes that may have occurred and give you an overall view of your financial health. You can get your FICO Score of 8 from major credit bureaus such as Equifax, Experian, and TransUnion. You can also get a free copy of your credit report from each of these bureaus once per year by visiting Annual Credit Report.

Understanding your FICO Score of 8 and taking the right steps to improve it is crucial for financial stability and success. Checking your score regularly and equipping yourself with the knowledge necessary to understand how it works can go a long way in helping you get the best loan and credit terms available. With the right strategies, your score will increase over time, giving you access to more financial opportunities!

What are some tips for improving your credit history and credit score rating?

Improving your credit history and credit score rating requires dedication and perseverance. Here are a few tips to get you started:

Pay bills on time

Making at least the minimum payment due each month can help improve your payment history, which is one of the most important components of a FICO Score of 8.

Avoid maxing out any of your credit cards

keeping the amount of credit you use below 30% can improve your score.

Maintain a healthy mix of revolving accounts (such as credit cards) and installments (such as mortgages or auto loans).

Check for any errors on your credit report

doing this regularly can help you detect any wrong information and keep your score accurate.

Establishing a good relationship with creditors

Communicating with them and trying to devise a plan if you are struggling financially can be beneficial.

Following these steps can improve your credit history and your FICO Score 8 rating! Remember: diligence is key; it can take time to see results. Stay focused on your goals, and you will be rewarded for your efforts.

FAQs

Is a FICO score of 8 the same as a credit score?

Yes, the FICO Score 8 is a type of credit score. It was introduced by the Fair Isaac Corporation (FICO) in 2019 and is considered one of the most widely used scores in the United States. The FICO Score 8 measures factors such as payment history, credit utilization, length of credit history, new accounts opened, and more to assess a person's creditworthiness.

How can I check my FICO Score of 8?

You can get your FICO Score of 8 from major credit bureaus such as Equifax, Experian, and TransUnion. You can also get a free copy of your credit report from each of these bureaus once per year by visiting Annual Credit Report.

What is a good FICO Score 8 rating?

A score of 670 or above is considered a "good" rating on the FICO Score 8 scale. You have demonstrated responsible financial behavior and will likely be approved for loans and credit at the best terms available. However, it is important to remember that each lender may have its criteria for granting credit, so even if you have a good score, you may still be denied in certain situations.

Conclusion

This article has helped to answer all your questions about the FICO Score 8. This score is an important factor in getting approved for loans and credit, so it's essential to understand how it works. To get a good score, focus on paying bills on time, keeping your credit utilization rate low, and reducing the number of new accounts you open. Additionally, monitor your credit report for any errors affecting your score.