What Is Income Smoothing?

Do you ever wish there was a way to make your income more predictable and reliable? You’re certainly not alone — whether it’s through variable pay cycles, uncertainty in commission-based income, or other factors—many of us face difficulty in predicting our overall financial status. Fortunately, this is where the practice of ‘income smoothing’ comes into play! This blog post will discuss what income smoothing is, why you should use it to increase your financial stability and security over time, as well as how best to leverage this technique for maximum results. So if you’re looking for ways to create more regularity around your finances then read on – because everything you need to know about income smoothing can be found right here!

1. Define income smoothing

Income smoothing is an investment strategy that seeks to reduce the variability of income by holding and reinvesting money over time. It helps smooth out fluctuations in your earnings and creates more consistency and predictability, allowing you to better plan ahead financially.it’s important to note that income smoothing is different from budgeting. Budgets are used to control and manage expenses, whereas income smoothing is focused on generating more consistent returns.

2. What are the advantages of income smoothing?

- It helps you better predict your income and identify potential financial risks.

- It can increase your ability to save, invest and build wealth over the long term.

- It gives you more flexibility in terms of how much money you can take out each month or year, which allows for more control over spending habits.

- Income smoothing can also help you diversify your income streams and protect against market downturns or other economic shocks.

3. What are the disadvantages of income smoothing?

- Income smoothing can be time-consuming and require careful planning.

- It may also prevent you from taking advantage of potential returns from investments, as money is held for longer periods.

- Additionally, income smoothing isn’t always feasible due to the amount of capital you need to make it work.

- Lastly, income smoothing can require complex financial planning and is not suitable for everyone.

In conclusion, income smoothing is an effective strategy to help create more consistency and predictability around your finances. It’s important to note that it requires careful planning and may not always be feasible depending on the amount of capital you have available. Ultimately, the decision to leverage income smoothing should be based on a thorough assessment of your financial situation and goals.

3. What are the best ways to use income smoothing?

-Set a specific goal: It is essential to have a well-defined financial goal before beginning any income smoothing strategy. This helps you focus on what you want to achieve and how best to reach your goals.

-Develop a plan: Once you have identified your goal, the next step is to create an income-smoothing plan that outlines how you will achieve it. This can include investing in stocks and bonds, setting up automatic transfers into savings accounts or other investments each month, or using tax savings.

-Monitor your progress: Once you have implemented an income smoothing strategy, it’s important to monitor your progress and adjust as needed. This could involve adjusting the amount of money you contribute each month or making changes to your investment portfolio.

Income smoothing is a great way to boost financial predictability and security, and by following these tips you can ensure that you’re always on track to reach your financial goals. With the right plan in place, you can be more secure about your finances both now and in the future.

4. Discuss the methods used to smooth income

There are several methods used to smooth income, including investing in stocks and bonds, setting up automatic transfers into savings accounts or other investments each month, using tax savings strategies such as contributing to a 401(k) or IRA, diversifying income sources by having multiple jobs or side businesses, and taking advantage of bonus opportunities when they present themselves. Additionally, many people will use a mix of these methods to tailor their income smoothing plan to best suit their unique financial situation.

No matter which method you choose, there are several key points to keep in mind when putting together an income-smoothing strategy. First, it’s important to make sure that your investments are diversified and that you’re not overexposing yourself to risk. Second, investing in stocks and bonds can be a great way to generate long-term returns, but it’s essential to understand the risks associated with each type of investment. Finally, budgeting and saving are two key components of any income-smoothing plan and should not be overlooked.

By following these tips, you can make sure that your income smoothing strategy will be successful and help you reach your long-term financial goals. With a well-thought-out plan in place, you’ll be able to create more stability and security with your finances so that you can enjoy greater peace of mind.

5. Examples of companies that use income smoothing

Companies often use income smoothing to give investors a more consistent financial picture and to improve their credit rating. Some examples of companies that have implemented income-smoothing strategies include Microsoft, Apple, Amazon, Walmart, and Coca-Cola. These companies have all used various tactics such as spreading out expenses over some time to optimize cash flow, taking advantage of tax savings opportunities, and investing in stocks and bonds. By doing so, they have been able to maintain consistent revenue streams, reduce their debt-to-equity ratio, and improve investor confidence.

In addition to these larger companies, income smoothing can also be beneficial for smaller businesses as well. Many small business owners opt to use income smoothing to manage cash flow more effectively, plan for future growth and expansion, and ensure that their businesses remain financially secure.

FAQS

How can I implement income smoothing in my business?

Income smoothing is a technique that can be implemented in many different ways. It typically involves setting aside money from your high-earning months to use during low-earning months. This allows you to have a more consistent cash flow and better prepare for periods of unexpected expenses or income drops. You could also consider diversifying your income streams, investing in assets that offer reliable returns, or creating a savings plan that helps you better manage and predict your finances. Additionally, budgeting, reducing expenses, and tracking your spending can help you get the most out of income smoothing.

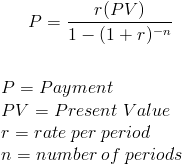

How do you calculate income smoothing?

Income smoothing is a technique used to create more consistent income patterns. To calculate your smoothed income, you need to take the average of your monthly income over the preceding 12 months and then divide it by 12. This gives you an estimate of what your average monthly income should be. You can then use this figure as a target for budgeting, setting aside money for an emergency fund, and planning out your financial future. Additionally, you can use this figure to determine what investments or other strategies may be necessary to help you reach that goal.

What is the difference between income smoothing and earnings management?

Income smoothing is the practice of setting aside money from high-earning months to use during low-earning months. This helps even out fluctuations in income, creating a more reliable and predictable cash flow. Earnings management, on the other hand, involves manipulating financial reports to make earnings look better than they are—which can have serious legal and ethical implications. Thus, while income smoothing is a positive technique to help you manage your finances and promote financial security, earnings management should be avoided at all costs.

Conclusion

When it comes to tax time, income smoothing can be a great way to minimize your taxes and maximize your deductions. By definition, income smoothing is the process of managing one's financial affairs to reduce the amount of taxable income during high-income periods and increase the number of deductible expenses during low-income periods. While there are several advantages to using this technique, some of the best ways to take advantage of income smoothing are through strategic investment planning and mindful spending habits.

If you're interested in learning more about how you can use income smoothing to your benefit, check out our FAQs below. And as always, if you have any questions or would like help implementing these strategies, feel free to reach out to us for assistance.